So here we are, 2022 - the start of a New Year. With it comes the opportunity to start afresh and set your business on the right path for the year ahead. Whether you’re in finance or HR, one of the big priorities for 2022 is to find ways to streamline and improve operations. Which is why reviewing employee spend should be top of the agenda.

An expensive expense

Tracking employee spend is one of the big challenges businesses have. It’s estimated that billions of pounds are lost in employee expense fraud annually, which can be attributed to a number of causes. This has been made even more complex over the past year, with a growing remote workforce, making it harder to keep on top of employee expenses and track spending.

It’s no wonder that 86 per cent of all occupational fraud cases involve the misuse of corporate funds. This can take many forms, including forgery, invoice fraud, payroll fraud, theft, fund misuse and expense fraud.

Before we delve into some of the solutions, it’s important to understand some of the challenges employees have too. All-too-often, employees are forced to pay for business expenses out of their own pocket, which can often take a long time to be reimbursed from the company. Not only does this impact on personal cash flow, but it can also prevent employees from taking part in events in the first place, in order to avoid paying upfront. These points should be given due consideration when looking at the overall picture.

How to stay on top of employee spend

Here are a couple of ways businesses can stay ahead of employee spend.

- Go digital

In these current progressive times, it’s easier than ever to request digital expenses. These are preferential to paper versions for several reasons, least of all because they are traceable and more eco-friendly. Using a mobile camera also means that technology can automatically recognize information, so there’s less chance of expenses being tampered with too.

- Use a centralized spend management system

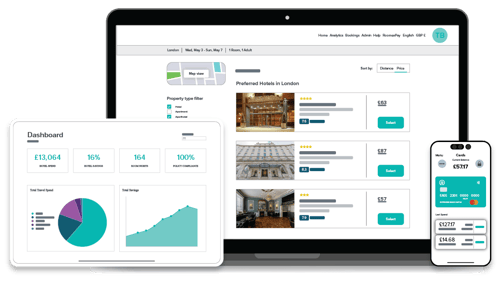

The best way to keep tabs on expenses is by using a spend management solution. A streamlined end-to-end process makes it super easy for employees to access and file expenses in real-time. RoomexPay is one of the leading providers, which offers a host of benefits for companies looking to gain control of their spend. Removing the burden of paperwork helps to prevent false claims and manual errors. Go one step further and equip colleagues with a RoomexPay card which instantly records all expenses, so colleagues don’t have to. A great way to save time and money!

- Set budgets

It may seem obvious, but many companies don’t clearly outline expense budgets for employees. So, when an employee travels for work, there’s no clear guidance on how much their meal, train, hotel, or taxi should cost. This can cause friction within the workplace.

Good news - this can be easily avoided by setting out clear guidelines or using a centralized travel management system with indicators for spend limits. Better again, using a pre-paid card, like a RoomexPay card, means the budget is set, and can’t be changed without authorization. These small tweaks can be hugely impactful on budgets.

- Create a spending policy

Create a clear, concise, and accessible spending policy, so there’s no room for misinterpretation. This helpful guide should explain company procedures and processes in order to keep employee spend on track. This should be included in your corporate handbook and travel management system too.

- Review costs that double up

In larger companies especially, there can be some disconnect between teams. Your company might be paying double for memberships, subscriptions, databases or advertising for instance. Creating a centralized payment method is a smart way to stay on top of these costs and consolidate cross-team spending.

- Looking at internal culture

A staggering 85% of employees have ‘fiddled’ their expenses, or incorrectly claimed, according to research. This is often down to ‘flaws in the system’ and poor expense control management. Companies can minimize this risk by putting measures in place to help prevent false claims, as well as create an environment where fraudulent behavior is not legitimized. This is an important point, since colleagues that ‘get away’ with false claims, may influence others to do the same. There’s a delicate balance between creating an inclusive culture of trust, whilst setting strict guidelines around expected behaviors and how these will be enforced.

Final thoughts

In these times, with displaced workforces and remote working, it can be especially hard to keep on top of employee spend. However, there are smarter ways of working, that can benefit organizations and their teams. When you look at the examples given, it’s not a case of whether you can afford to put these measures in place – it’s a case of whether you can afford not to.

Tags:

Finance

January 19, 2022