One of the most important disciplines required for work travel is knowing how to manage your expenses. From incidentals such as cups of coffee, to larger costs such as client lunches and transportation - every penny, cent, and dime adds up.

The only way to stay on top of your outgoings is to use travel and expense policy best practices.

If you’ve been in the industry for some time, you may be familiar with some of these, otherwise here’s a few insightful tips to note.

Know your Corporate Travel Policy

First thing’s first, it’s important to review your company’s travel policy guidelines. Every business will have their own set of rules and processes which are important to be aware of. This may include preferred suppliers, per diems, or capped costs to consider.

There may also be guidelines around expense due dates and payment timings, useful to know for staying on track.

When the Company Pays

Although it’s standard practice for most companies to have travel and expense policy best practices outlined in a corporate travel policy, not all do. If this is the case, ask colleagues if there’s a process or corporate account for taxis, hotels and transport.

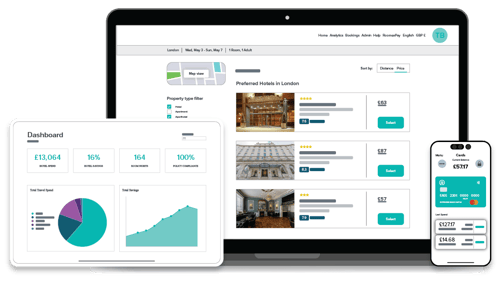

Most companies will have either a travel agent or self-service portal for hotel bookings and flights. Some will have a corporate account for taxi bookings and executive cars.

Booking through these methods means your company picks up the cost and not you. It’s a useful way to reduce the amount of expenses you incur and therefore need to claim.

There might also be a company ‘float’ which is ad-hoc cash for incidentals. This could be for parking tickets or booking a courier or even getting a team lunch. Although you will still need to retain your receipt for the claim, it isn’t at least coming from your pocket.

Plastic Speaks

Some travel and expense policy best practices offer employees a corporate credit card. This can take some of the challenges out of business travel. However, you will still need to submit receipts against your bill, so it’s important to have a system in place.

If you don’t have access to a company account, you may wish to open a separate bank account (or take out a credit card), specifically for work purposes. Just remember to pay the balance in full every month so you don’t incur charges. Some people find this a good way to separate costs and keep track of spending.

Travel Wallet

Seasoned business travellers will know the benefits of a dedicated travel wallet for expenses. This requires some organisation and due diligence, but is an easy habit to get in to.

Accordingly, all claimable receipts should be saved in your wallet and audited weekly or monthly. You may wish to go even one step further and label them for ease, this will help identify costs when you go to claim against them.

Another useful travel and expense policy best practice is to find a routine for expenses. Rarely will a company be grateful that you’ve let them pile up, some may even refuse to pay late submissions. One way around this is to dedicate a day every month, perhaps the last Friday in the calendar, to go through receipts for submission. Granted, administration isn’t the most exciting task, but it’s important practice for good business management.

Keep a Mileage Log

If you find yourself driving a lot for work, then a mileage log will help you maintain a record for claiming back fuel and possibly wear and tear. Use your smartphone to take a snapshot of your mileage at the start and end of each trip. When it comes to claiming back, use a mileage calculator such as the AA (or your company’s preferred source) to calculate costs.

Use your PA

If you’re in the privileged position of having a personal assistant, they may be able to take on general administrative tasks. One of these include managing personal expenses. They should also know their way around the company travel and expense policy best practices, allowing them submit claims on your behalf.

…Or Use Software

There’s an App for everything these days, business expenses included. Indeed, the digitalisation of expenses is the future.

Predominantly used for accounting, Quickbooks is one of the more popular systems, which your company may already have access to. If not, there’s a monthly fee starting from £6 a month.

Mint is another great resource, which can also be downloaded as an App. This free money management tool can also keep an eye on spending habits especially expenses.

There’s many other apps and software that also allow you to take photos of receipts for instant digital submission. If you’re time-poor, it’s a great tool to invest in and all you need is a smartphone.

Tags:

October 17, 2019