Corporate travel is back, and while it’s yet to reach the demand of pre-pandemic levels, it’s a positive step towards some normality.

However, given the time we’ve had to reflect on the cost of business travel, things have changed a little when it comes to business spending. We’ve all had to tighten our belts, and reign in unnecessary spending. And, yes you guessed it - one of the biggest contributors to excess business spending is incidentals expenses.

But in this new era of post-covid travel what are incidentals expenses and how can they creep up on you?

What are incidental expenses?

Every company has them – incidental expenses are known as the minor costs that are incurred as part of a job. This might be the cost of an evening meal whilst away on a project, transportation for meetings, accommodation for remote workers and even gratuities.

However, these seemingly every day expenses can add up and over time, especially in companies with lots of remote workers, and these costs can add up to a significant amount. Here’s just how the cost of business travel expenses might be affecting your bottom line:

Unplanned costs

It’s an easy oversight to make, and frequently line managers can overlook the hidden costs of incidental expenses. Often this may be down to a lack of clarity or guidelines around the process for hotel bookings, capped limits on travel expenses, or ambiguity around per diems whilst away on work. With the average company spending £750 per colleague annually on business travel, there has to be better planning and accountability when it comes to business spending.

Delayed reporting

But even when business expenses are factored in, there can be other unexpected hidden costs. These might be credit card fees, or late payment fees. And even late or built-up expenses can incur extra costs or require a large payment that might not have been planned for.

The incidence of fraud

While the vast majority of employees are honest and hardworking, there are unfortunately exceptions. Fraud costs the UK market over £137 billion every year, and you can bet that a fair amount of this comes from business expenses.

The cost of administration and time

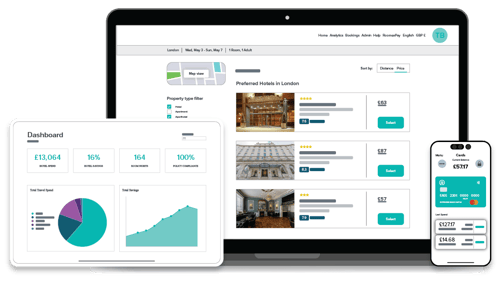

We’ve all filed business expenses, and know how onerous it can be. Not only are hours wasted every year from this administrative-heavy task due to filing expenses, but there’s the added time wasted for correcting and approving them from finance teams. If time is money, then this is one hidden cost you may not have taken into account. Platforms like Roomex can alleviate this by providing time-saving alternatives to expenses like hotel allowances and prepaid cards for travelling workers.

Expensive for colleagues

Finally, let’s not overlook another important point. In many cases, colleagues will have to front the cost of business travel and claim it back later. This can be unattainable for some individuals, and may prevent them from travelling in the first place, or worse still, leave their jobs. These actions undoubtedly impact a business’ bottom line.

How to keep business spending on track

Let’s be clear, however, that business spending is necessary in order for employees to carry out their work successfully. However, there are smarter ways of managing spend and expenses, that can reduce the cost of business travel, without cutting back on essential face-to-face meetings, here’s how:

Introduce a streamlined booking platform

Without any guidelines in place, colleagues can book hotels and transport at peak prices, which is not great procurement practice. An easy way to avoid this is to introduce a self-service travel platform, that allows colleagues to book and cancel hotels and transport in an instant. The list and cost of suppliers are always pre-approved by the company. What’s more, with Roomex, bookings are directly billed to the company after check-out, which removes the need for handing in late or costly expenses that may not have been pre-approved.

Automated or pre-paid expenses

There are numerous digital solutions and apps that can help keep track of business spending, including pre-paid expense cards. Since these can help colleagues from spending out of their own pocket, they’re a great solution too. Plus, companies that use automated expense management systems are 25% more efficient than those who don’t. Going digital also reduces the incidence of fraudulent claims, which are especially important to keep an eye on in post-covid travel.

Set clear guidelines

It pays to have clear guidance and a robust travel policy for colleagues to refer to be it business or workforce travel. This should include details around acceptable expenses, process for making and changing bookings, and your corporate travel policy in full.

If you’re looking for an all-in one solution for workforce travel, or to learn more about prepaid expense cards, speak to us today.

Tags:

Finance

May 5, 2022