The UK economy remains in an uncertain place. Whilst the continuous interest rate increases of the last year may have slowed, there doesn’t seem to be a clear consensus that the road ahead will be smoother. ‘Higher for longer’ may be a common view, but that doesn’t exactly bode well for procurement and cost control. Business travel costs and specifically hotel rates continue to be hard to read, the indicators we do have might provide some short term respite, but not much. Either way, these insights will help you form your hotel pricing strategy for the coming quarter.

Introduction

ADR (Average Daily Rate) in Q3 has been more robust than expected. In recent years, the summer period has provided an exceptional high in hotel rates which has quite quickly dissipated into the autumn period. 2023 has performed a little differently. The price tailwind has been powerful but coming from a different source - inflationary pressures rather than COVID buying behaviour. This seems to have produced a different trend as we transition from summer into autumn. Total demand levels - room nights sold in the UK hotel market - jumped at the start of September as would be expected. However, they increased more strongly than 2022. This has lead to more robust ADR. Recent weeks though have shown a weakening in growth. Is this a glimmer of hope for travel buyers?

Forward Pricing

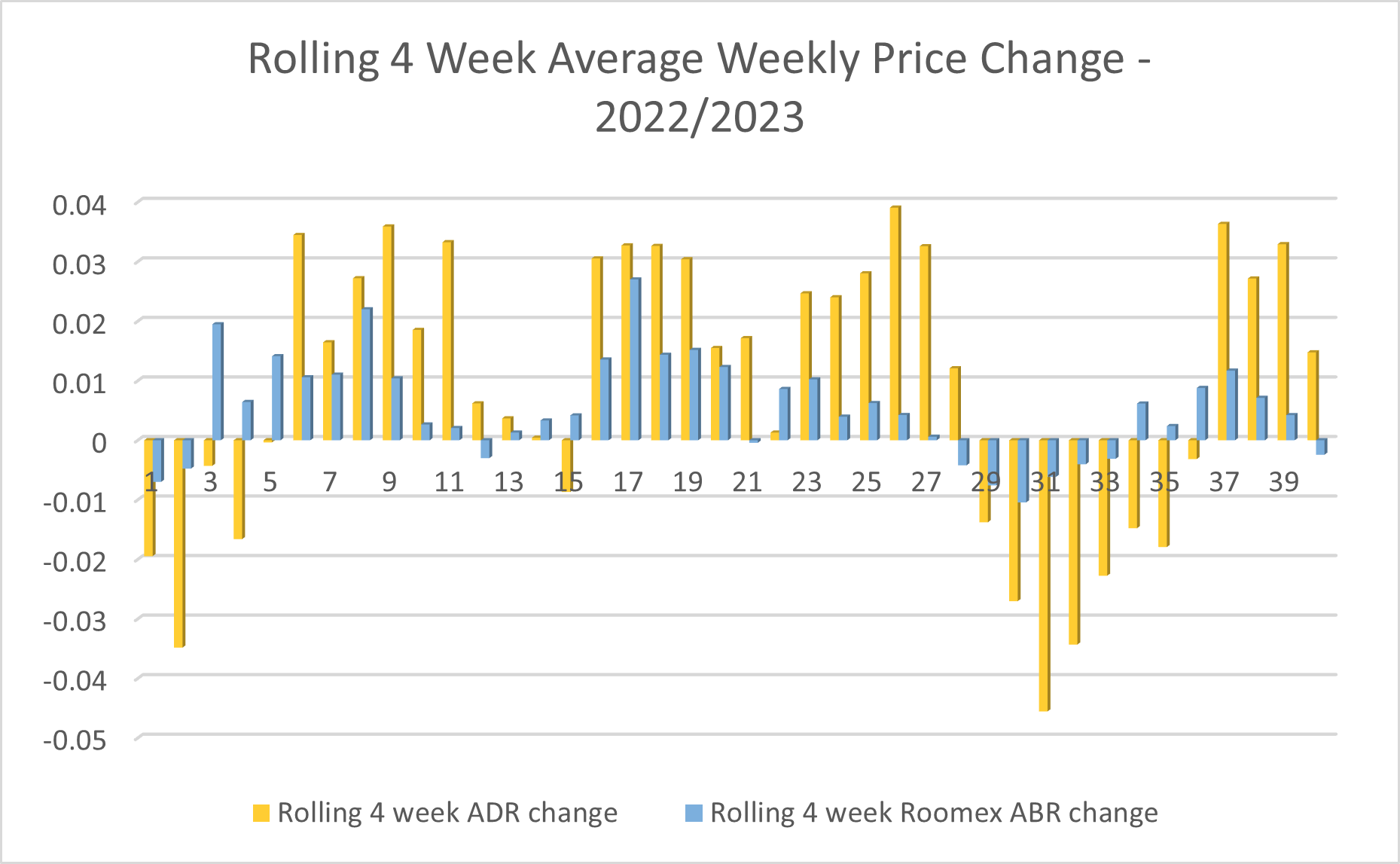

The rolling market ADR graph shows strong increases in September. Whilst hotels continue to face inflationary pressures on input costs - labour being at the top of the list - there has to be sufficient demand in the market to support ADR. This was initially the case in September.

However, the graph shows signs of decline. Detailed comparisons with 2022 are not easy with 2022 impacted by the Queen’s death, but in 2023 there has been several weeks of consistent demand decline from a week 37 peak of 3.0M room nights sold to 2.8M in week 40. With school half term looming this is likely to continue. For context, autumn 2022 UK hotel demand peaked in week 41 - mid-October - after which demand and prices eased back. ADR declined - 16% from the 2022 high point in July down to the average November rate. So far 2023 is -8.2% off the July peak, so there is likely to be more to come.

Roomex’s hotel rate strategy brings discounts to business buyers, but it also serves to smooth out ADR peaks. The combination of Roomex Fixed Rates and Client Rates cuts off the peaks of market ADR.

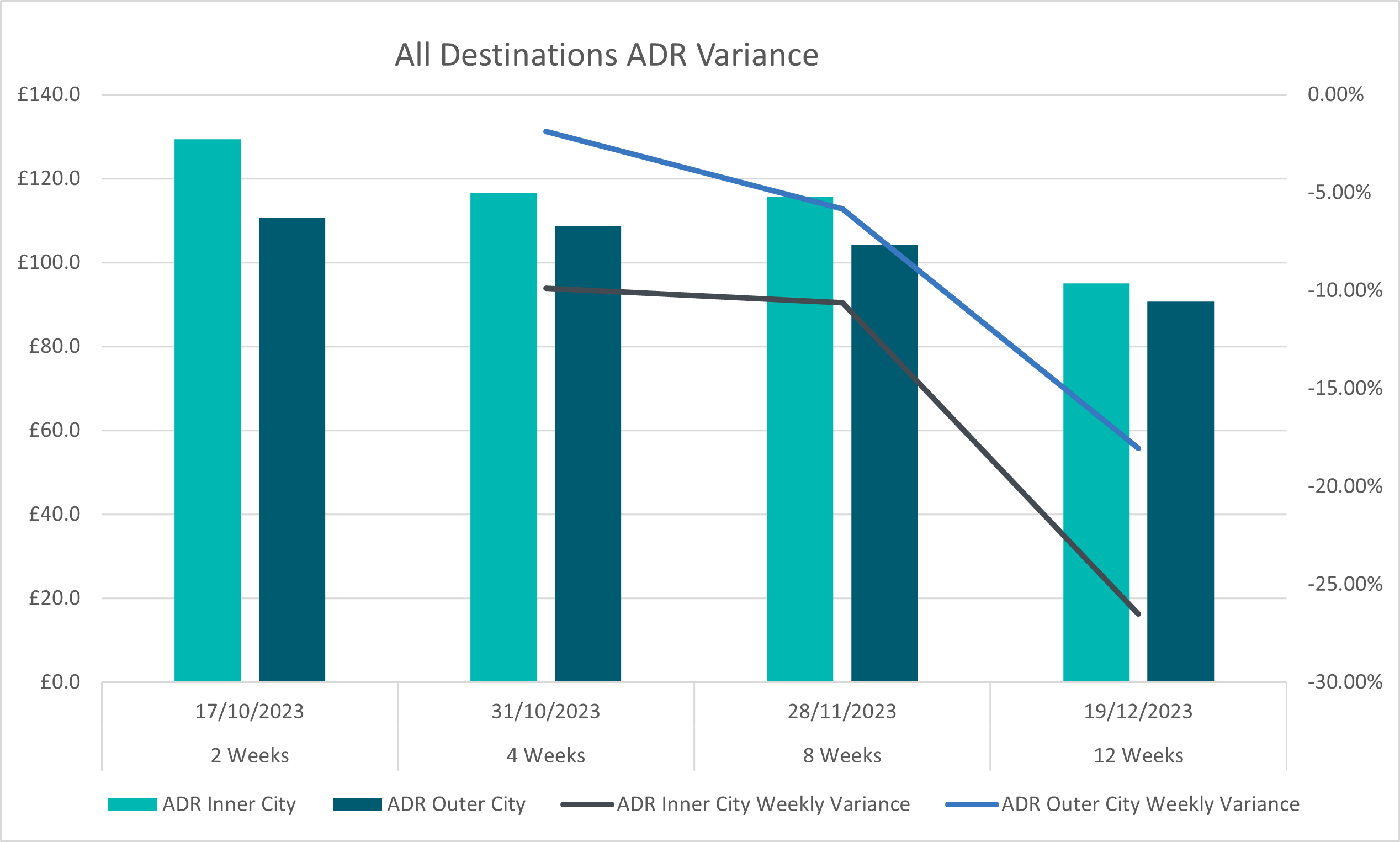

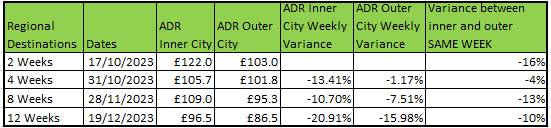

Forward price data seems to support further hotel price declines, but they don’t look to be steep. Across all location types, 2, 4, and 8 week forward prices show relatively small but consistent decline. The 12 week forward indicators also suggest price declines, which speaks mostly to a downbeat mood amongst hotel revenue managers with regard to seasonal leisure in December.

Gateway cities see sharpest ADR decline. Secondary locations (Birmingham, Manchester, Glasgow etc.) perform strongest compared to gateway cities and regional towns, giving away little through to the end of November. Interestingly in these secondary locations, out of town destinations perform better than inner city in terms of actual ADR and ADR change through the autumn - they stay higher for longer.

Many Roomex clients have a broad footprint in terms of destinations visited as a result of project work. Regional towns show weaker performance in outer locations.

As always there are outliers in the data. Cardiff looks particularly strong in the autumn period, with rates likely being driven by events. Hotel brands are also applying their own revenue management strategies and addressing the market as they see fit. This in itself provides saving opportunities for buyers.

Summary

The forward data suggests hotel prices are holding up and the declines into the winter will not be sharper than 2022. Cost increases for hotels that previously had been around energy are now entrenched and labour costs continue to impact.

There is currently considerable price variance between similar starred hotels in similar locations. It’s easy to think that there are enough hotels in any particular destination to smooth out but it’s not the case. Different market positioning and brand power creates highs and lows. Being able to see through the noise and find those savings potentials is something we would strongly encourage buyers to be paying attention to in the weeks ahead and contemplate as part of their hotel pricing strategy.

October 27, 2023