Managing company-wide spending on business travel is tricky as there are so many factors to account for – least of all staffers who may like to splurge. Without a regimented programme in place, gaining visibility into where that spending goes is nearly impossible.

Still, that doesn’t mean the CFO is off the hook. The average day of travel will run at a cost of £117 per person and accommodation accounts for roughly half of that total, according to Budget Your Trip. When you’re sending a single employee to one or two conferences each year, that’s not a scary number; it’s when you have multiple team members who are regularly on the road that it begins to take its toll.

A lack of transparency, poor policy engagement and non-existent innovation can drain the coffers in a business travel management programme, leaving the finance department empty handed. Here are five ways CFOs can flip the switch and start reducing those costs once and for all.

1. Make KPIs a sticking point

Yes more metrics to track – but we promise it works!

While a travel booker will do the actual booking, their actions directly impact the business’ financial viability. If they don’t have an excellent understanding of the cost of every decision they make, it’s more difficult to curtail spending.

Set and follow Key Performance Indicators (KPIs) on a quarterly, bi-annual and yearly basis. While this on its own won’t help a company reduce business travel costs, it can highlight some of the worst offenders of overspending.

KPIs that every team should be monitoring include:

- Transactional costs (hotel bookings, flights, food, etc.).

- Travel volume by individuals, roles and departments.

- Realised and expected savings through negotiated and dynamic pricing on hotel stays.

- The rates in which spending is within or overextends predetermined guidelines.

Develop agreed upon thresholds in terms of where these numbers should fall and hold team members accountable for meeting them. Project manager Jim might think the extra coffee money he’s spending onsite isn’t really hurting the budget, but if every employee takes that approach, the pounds quickly stack!

2. Foster a culture of travel engagement

Company culture is the buzz term of the year for HR, but it’s also just as valuable for finance. One of the main culprits of business travel overspending is people simply not following policy.

It’s the result of a number of issues, all of which can be solved. These include:

- General lack of employee engagement across the board.

- Poor duty of care.

- Unrealistic travel arrangements.

- Substandard accommodation.

- Complicated travel processes and policies.

By devoting a portion of management’s time to solving these problems as best it can, employees will reciprocate by following the policies more closely. Create a beneficial travel experience for your team members and watch the savings start to pile up.

3. Regularly review business travel experiences

Business travel doesn’t have to be a one-way transaction. Travel bookers and CFOs alike should regularly collaborate with one another to figure out how they can innovate and create a better travel programme.

Much of the feedback should come from employees who have recently travelled. Interview them to understand what they liked or didn’t like about the experience and what potentially led to overspending.

All of this should feed into a board-approved business travel programme that is built for compliance and designed to be a cost-effective solution.

4. Get the whole picture on spending

In the wrong hands, business travel can be mired in hidden costs.

Many travel bookers will do it manually: they’ll go online and compare prices on booking websites – many of which are for leisure travel – and they’ll end up booking a stay that isn’t appropriate or shelling out extra. Other companies will use an agency or they’ll fall into the trap of paying consumer rates, rather than benefitting from negotiated or dynamic pricing models.

It’s a common practice but it can have a negative impact on finances as a business hotel booking platform will give users greater visibility over their plans.

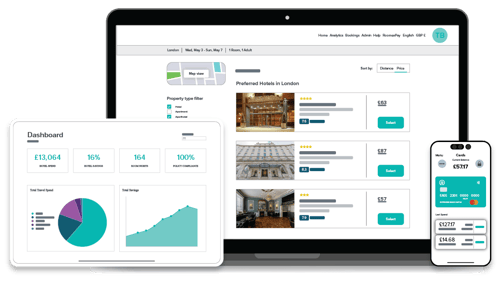

A specialised business hotel booking platform takes the sting out of the task as it searches hotel prices for you to give you the best options for your team.

Plus, the system can be key to avoiding hidden costs that might crop up in unfamiliar hotels – for example having to pay extra for parking or Wi-Fi. These platforms are built to make booking hotels simpler and many give increased visibility over expenses and spending as it can be tracked from an integrated dashboard – which is music to any CFO’s ears.

For example, companies booking in the last quarter saved €1.17m with Roomex’s business hotel booking platform, so it’s absolutely worth investigating.

5. Bring analytics into the fold

Time equals money and many haphazard booking strategies or disorganised spending policies can contribute to generally inefficient spending.

Use a business hotel booking platform to align multiple teams under one umbrella and apply an analytical view to how they operate. By centralising the booking process, organisations gain real-time visibility into their spending and can efficiently make impactful changes.

It’s time to get your company’s business travel finances back in the black by leaning on digital tools that make everyone’s job easier.

Are you looking to streamline your company's business hotel bookings? Get in touch with one of our experts today to learn how Roomex can help.

February 18, 2019