When it comes to business budget tracking, there’s a growing number of digital tools to manage spend in an effective and efficient way. One of the big trends for the year ahead is virtual payment cards, which are quickly becoming the go-to preferred payment option for employees worldwide. The market is experiencing huge demand according to the latest statistics, which predict a 90 per cent growth in the coming years, and usage to surpass $1 trillion this year alone.

If you’re new to the concept, a virtual card is an evolution of the humble debit card – except it’s created exclusively online and forgoes the need for a physical version. Virtual cards tend to be held on smartphone devices or laptops for online transactions, and sometimes go by the name ‘temporary’ or ‘pseudo’ card.

Although they are designed for the same purpose as a debit card, there’s a number of additional benefits they offer. Here’s just a few of them:

Helps prevent fraud

The most obvious benefit with virtual payment cards is that they can’t be lost or stolen like a physical debit card. Ergo, this makes them far more robust against fraud and cybercrime. Should you suspect suspicious activity, they are also much easier to cancel than a debit card, which the user can do in a matter of clicks. However, it’s their resilience against e-commerce fraud that makes them so beneficial. When employees make a transaction, a one-time number is provided to help identify them. This has proven highly effective against credit-card fraud, and one of the key reasons why businesses are moving over to them.

Highly convenient

For employees, there’s a great benefit in anything that saves time, administration, or stress, and virtual cards tick all those boxes. They offer a highly convenient option for tracking expenses 24/7, and since they are always accessible via a mobile digital wallet, they can be used anywhere at any time to make a payment. Unlike using personal credit cards, employees aren’t left out of pocket, waiting for expense reimbursement to come through. What’s more, unlike traditional banks with set opening and closing times, users can access support, or make changes to their account online at their convenience.

Companies can set limits and stay in control of spend

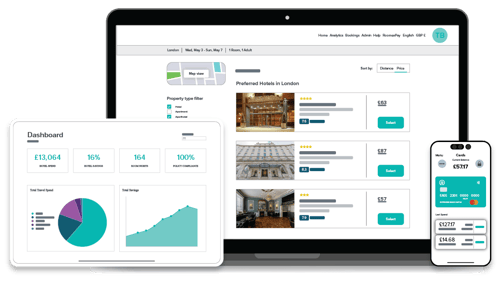

As a business, equipping employees with virtual cards is a great way to track employee spend and keep on top of cash-flow. Popular virtual payment cards, like RoomexPay, are designed with businesses in mind, allowing companies to customize limits and track spend in real-time. What’s more, businesses can stay in control of spend, by limiting cards to certain dates and times with allowance options – useful for business trips and trade events for instance. Overall, this can help with better internal transparency in the expense process, and best of all - they’re highly affordable at just £6 per virtual expense card.

Takes the admin out of expenses

There’s no excuse for late expenses and lost receipts when employees use virtual payment cards. Payments can be tracked digitally with all the necessary virtual paperwork in one place. This can massively speed up the expense process for all parties, and relieve administrative stress, whilst keeping track of expenses.

Manage subscriptions and memberships

Keeping control of cross-company spending has never been easier. When virtual cards are used for subscriptions, advertising, or memberships for instance, you can track if a merchant overcharges you, press pause if you’re on holiday, or cancel the service in a matter of clicks. This puts users back in control of spending in an easy and transparent way.

Virtual payment cards in summary

Advances in technology make it easier than ever to keep control of finances in an effective and simplified way. Through the use of virtual payment cards, businesses can drill down into spending, manage expenses, and help to limit fraud, as well as make numerous cost-savings in the process. For the end-user, there’s a myriad of benefits, as well as convenience that comes with it. No wonder virtual cards are the big finance trend of the year.

Tags:

Finance

March 3, 2022