Collating receipts, verifying extensive expense claims—when you travel regularly, or have employees who travel regularly, managing business travel expenses can be a headache. But, there can be a more straightforward solution: per diem allowances.

Per diem allowances provide a fixed daily rate for meals, accommodation, and incidental expenses, simplifying the reimbursement process for all parties involved.

For companies, per diem allowances reduce the administrative burden by standardising expense claims across multiple trips. For employees, they offer convenience and peace of mind, eliminating the need for meticulous expense tracking.

And, with global spending on business travel set to reach $1.5 trillion in 2024—beyond pre-pandemic levels—efficient expense management has never been more crucial.

In this blog, we’ll answer some of the most common questions about per diem allowances for business travel, including ‘What does per diem mean?’, ‘Are per diems taxable?’, and ‘What per diem rates can I expect?’

What is a per diem?

Per diems are daily allowances paid to employees to cover business travel expenses, including accommodations, meals, and incidentals.

The concept simplifies expense management by providing a fixed amount for each travel duration—from five hours to 24 hours or more—eliminating the need for individual reimbursement claims.

In the UK, HMRC suggests specific rates for travel to various locations globally.

Per diems are easier for employees, too.

As of April 2019, you no longer need to provide receipts for meals or incidental expenses when you travel. Instead, you simply need to demonstrate you were on a business trip at the time.

Note: there are a few exceptions to this. If your company claims specially agreed custom allowances or industry-agreed rates from HMRC, you’ll need to keep receipts.

How is per diem pay calculated?

Per diem pay is calculated based on set rates determined by HMRC for travel within the UK.

These rates vary depending on the travel duration, ranging from £5 for 5 hours or more, £10 for 10 hours or more, to £25 for 15 hours or more with ongoing travel after 8 pm.

For travel over 24 hours, you can also claim the room rate of any accommodation booked on top of the per diem rate. There’s no benchmark for this, so employers will need to agree on bespoke rates with HMRC.

| Duration of travel | HMRC per diem rate |

| 5 hours or more | £5 |

| 10 hour or more | £10 |

| 15 hours or more (with travel ongoing after 8pm) | £25 |

| 24 hours or more | £25 + room rate agreed with HMRC |

Rates for overseas travel are also provided by HMRC, with rates varying depending on your destination. Find the full list of scale rates provided by HMRC here.

There are a few rules when it comes to claiming per diem allowance.

- You need to be travelling to perform your usual work duties, or to a temporary place of work.

- You need to be continuously absent from home or your usual workplace for at least 5 hours.

- You need to have incurred the cost of a meal or accommodation after your travel period has begun.

Is subsistence allowance the same across all companies?

It can be, depending on whether you use the HMRC standard rates.

If your expenses are usually more than the standard rate, employers can agree on a custom rate with HMRC based on past employee expenses. They can pay you more than this agreed rate, but doing so has some tax implications—which we’ll cover in more detail further down this blog.

Alternatively, employers can use HMRC's benchmark rates. However, these rates may change, so it's crucial to stay updated. If you or your employees are staying in standard accommodation and accessing budget, low-cost eateries the standard rates should suffice. Sometimes, though, they can leave employees out of pocket.

Is per diem on top of salary?

In a word, yes. Per diem allowances cover specific expenses incurred during business travel, providing employees with a clear and consistent reimbursement method.

Paying per diems rather than simply increasing salary to cover business travel costs makes good tax sense too - for companies and employees.

Why? Because expenses from business travel do not incur taxes or National Insurance contributions.

Are per diems taxable?

Paying per diems within the HMRC scale rates or bespoke agreed rates are tax-free, but amounts exceeding these limits are subject to taxation and National Insurance Contributions (NICs). Companies can deduct business travel rates from their taxable income, too.

Sometimes the baseline rates or even agreed rates can feel unworkable—especially if meal or accommodation options in a destination are limited to more expensive establishments.

To make sure their employees aren’t out of pocket on business trips, employers can choose to pay you more than the agreed rates, but they must account for the tax implications accordingly.

Expenses that go beyond the HMRC limits are considered taxable benefits to employees.

What are the benefits of per diem pay?

Offering a per diem allowance to manage business travel expenses can enhance employee satisfaction and morale by reducing financial stress during travel. It can help streamline the expense management process for both employers and employees, make travel arrangements more flexible for employees, and ensure that business travel is cost-effective.

Per diem allowances also promote fairness and transparency in expense reimbursement, ensuring that employees are adequately compensated for expenses related to their job duties.

Wrapping up per diems

Managing business travel expenses can be a complex and time-consuming task for companies. From booking travel and managing payments on the road to calculating travel budgets and tracking expenses, there's a lot to consider.

This process becomes even more critical if companies want to establish agreed scale rates with HMRC for per diem allowances.

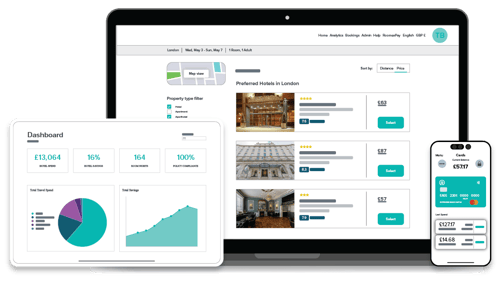

At Roomex, we offer a comprehensive solution to streamline business travel management.

Our platform simplifies hotel bookings and payments and provides real-time analytics and expense-tracking tools. With Roomex, companies can easily manage travel expenses, track spending, and ensure compliance with HMRC regulations.

February 21, 2024