To access the PDF version of this report with the H1 event calendar and negotiated hotel rates click here.

Author's Note

In anticipation of the early months of 2024, our forward price data indicates a notable uptrend in hotel prices. Across regions, a robust increase in prices is expected, mirroring trends observed in previous quarters. However, there are distinct variations in the timing and pace of these price escalations.

- Regional Price Surge: Forecasts suggest that travellers will experience a strong rise in hotel prices across regions, particularly evident in the early months of 2024. A large number of trade shows and leisure events in key cities across the UK and Ireland will be expected to contribute to an increase in demand and, as a result, lead to prices climbing at a steady rate.

- London's Delayed Increase: Contrary to the regional trends. London's hotel prices are projected to exhibit a slower pace of growth initially, with indications pointing towards a delayed surge, likely to commence in late February. This delayed response may stem from unique market dynamics within the capital.

- Consistency with 2023 Trends: Analysis indicates that the trajectory of price growth from January to the summer months is anticipated to parallel that of the previous year, reflecting a stable pattern in market behaviour. Such consistency provides valuable insights for stakeholders in the hospitality industry to strategise and adapt accordingly.

In summary, while early 2024 shows promising prospects for hotel price increases, nuances in regional dynamics and the delayed surge in London warrant careful attention. Understanding these trends and their implications can empower stakeholders to make informed decisions and optimise strategies in response to evolving market conditions.

Keith Watson - Chief Operating Officer at Roomex

Q1 2024 Hotel Forward Pricing

The UK Consumer Price Index (CPI) rose to 4.2% for the 12 months preceding December 2023. This was an increase on the 3.9% preceding November. It paints a picture that inflation is significantly down compared to the levels seen 6-12 months ago, but a steady decline cannot be taken for granted. Whilst the drivers behind this increase have been pinned on some specific price rises (tobacco and air travel being high among them) input costs for hotels are of course much higher than this time last year. The question is, how the mix of rising costs, demand levels and seasonality will play out and impact hotel procurement in the UK and Ireland.

Introduction

Average daily rate (ADR) has started the year in a fairly muted way. In the first 3 weeks in January, Roomex saw its average booked rate rise 3.9% on the same period in 2023. This is behind the same period in 2022 (+4.6%). Demand being relatively low doesn’t give hotels enough traction to increase rates faster but buyers shouldn’t take this low rate period as an early indicator for future months.

Report

Staying with the 2023 comparison, price development was relatively subdued through to April. Between March and April price development was +7.6%. It’s also worth noting that the Roomex platform insulates its customers from wide price fluctuations through the combination of Client Rates and the Roomex Rate programme. Looking at 3rd party market data in the UK, ADR in the first 3 weeks of 2024 was +5.1%; a steeper increase than the Roomex platform and from a higher base. For Roomex customers seasonality became impactful in April last year (+7.6% month-on-month), but the broader market stepped up +11.8% month-on-month and a month earlier.

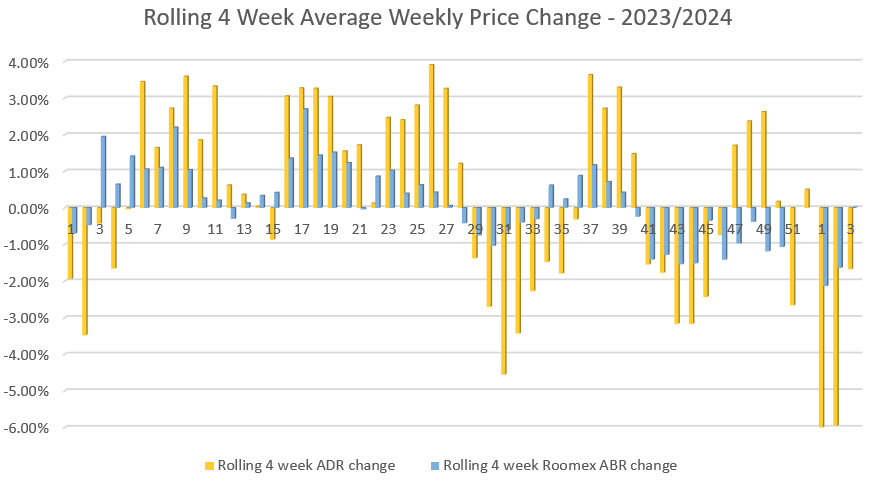

The below chart shows the rolling 4 week price movement over the full year 2023:

Taking in the full year, the continuous upward movement through the first half of the year is evident. The drivers being the powerful combination of both inflation and seasonality. Only the summer period and a weak Q4 brought the run to an end.

We also see an enlarged difference between budget hotel brands in periods of low demand. Higher quality brands are able to hold price in weaker periods and trade-off the brand strength they enjoy. Weaker, less well known chains drop prices further.

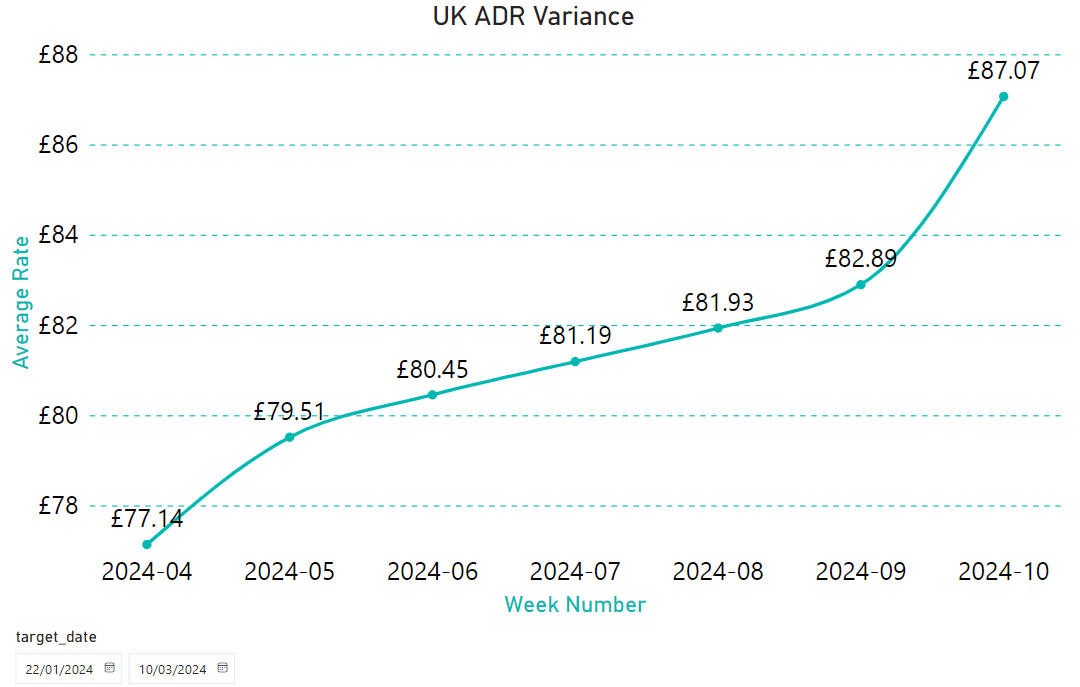

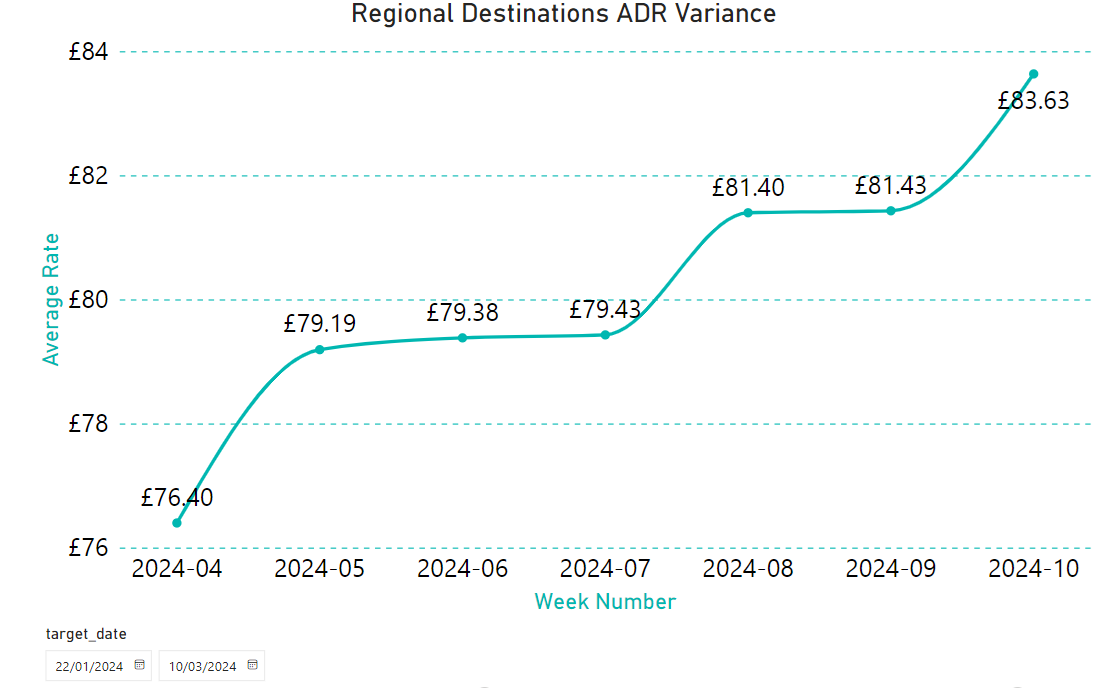

Looking ahead at the forward market data, overall there is a strong and continuous upward trend.

The first 10 weeks of the year forecast an upward trend to the tune of +15.3%. Bear in mind, week 1 is always a low point and forward pricing beyond 6 weeks becomes less reliable.

"...For Roomex customers, seasonality became impactful in April last year (+7.6% month-on-month), but the broader market stepped up +11.8%..."

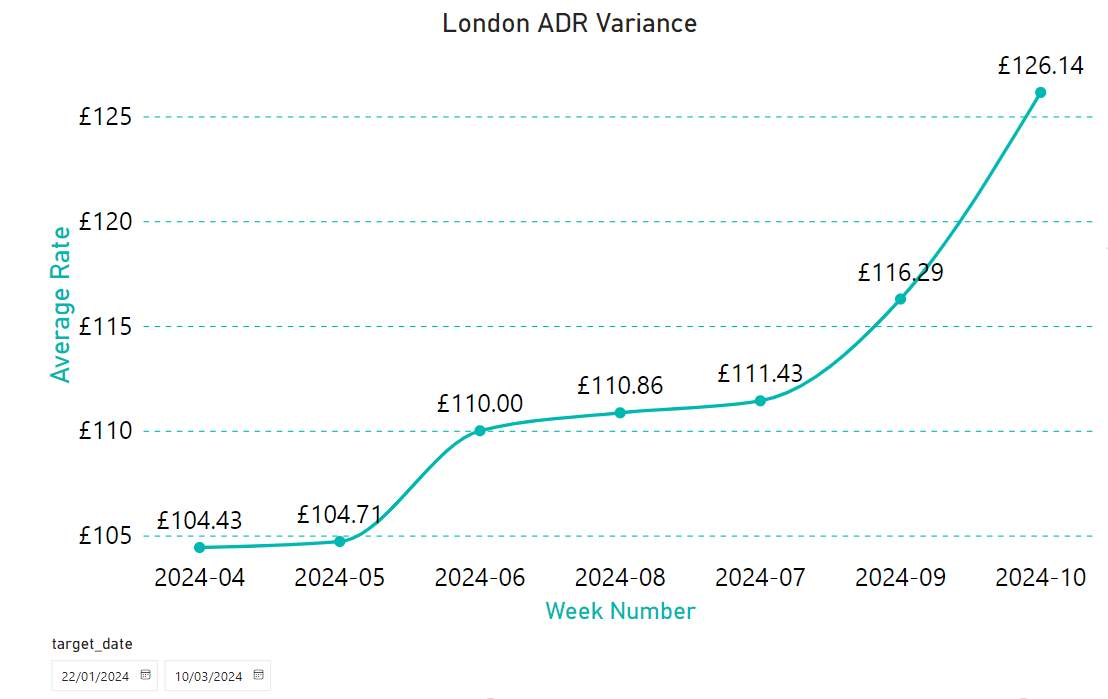

Breaking this out by regions, London in isolation takes its time for price to get traction - a level of demand is required for hotel systems to yield against.

The first week in March is forecasted to steep increases which is not the case country-wide.

At the other end of the spectrum, Regional destinations, which include locations such as Cambridge, Sheffield, Plymouth, and Northampton, show a much earlier price pick up.

Summary

After 2023 we might have hoped for a more subdued price environment, but the year hasn’t started that way and the near future also shows strong price increases.

It’s well worn advice that if you book early you will secure better prices. This is often not useful for business travel because of constraints on timing of booking. However, from a budget and planning perspective the trend looks robustly upwards from this point.

At the end of 2023 Roomex purchased an external price forecast for the whole UK market. It showed a January to August trough to peak increase of +42.7% ADR. Our forecast and working assumption at Roomex is that we can protect customers from most of that and limit that inflation/seasonality driven rise to +20.8%. We’re always happy to advise customers on their specific requirements.

About the Data

Sample set of 50,000 price points used from UK and Ireland Hotels. All data is from 3 star hotels only to reflect Workforce travel requirements

Research and Analysis

Keith Watson

Robert Sullivan

To access the PDF version of this report click here.

February 1, 2024