To access the PDF version of this report with the H1 event calendar and negotiated hotel rates click here.

Author's Note

As we delve into the latest insights regarding forthcoming hotel prices, it’s imperative to navigate through the intricate landscape shaped by a myriad of economic factors and market dynamics. This author’s note aims to contextualise our findings, offering a nuanced perspective on the anticipated trends and their implications for stakeholders in the hospitality sector.

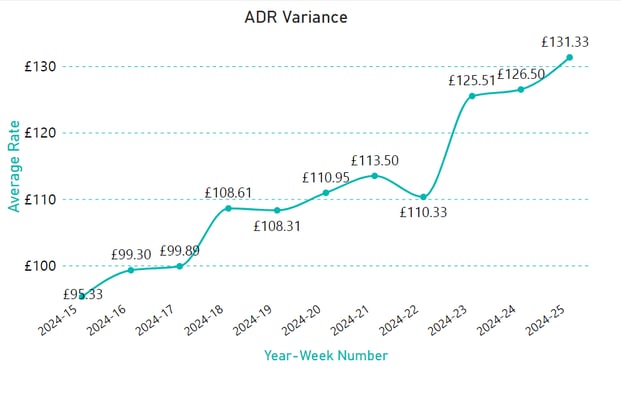

1. Significant Price Fluctutations: Our analysis of forward pricing data unveils a striking possibility of a 37% surge in hotel prices between weeks 15-25 of the current year. This substantial uptick underscores the volatility inherent in the hospitality market, urging stakeholders to adopt proactive strategies to mitigate potential impacts on budgetary considerations and consumer demand.

2. Impact of Economic News on Q1 Prices: Despite the anticipated price escalation, the first quarter of the year witnessed a softening of hotel prices attributed to unfavourable economic news. Understanding the interplay between economic indicators and pricing dynamics is crucial for informed decision-making in resource allocation and financial planning.

3. Moderated Year-on-Year Increases: In contrast to previous years, the year-on-year hikes exhibit a notable moderation, owing to mitigated inflationary environment. This deceleration in price growth signals a shift in market conditions, necessitating a recalibration of strategic approaches towards revenue management and pricing optimisation.

In summary, while early 2024 shows promising prospects for hotel price increases, nuances in regional dynamics and the delayed surge in London warrant careful attention. Understanding these trends and their implications can empower stakeholders to make informed decisions and optimise strategies in response to evolving market conditions.

Keith Watson - Chief Operating Officer at Roomex

Q2 2024 Hotel Forward Pricing

Forecasting Average Daily Rate (ADR) consumes a lot of time at hotel companies. Data scientists and revenue managers pour over historic trends, business on the books and pace trends. Revenue management software crunches through huge volumes of data, no doubt using the latest machine learning algorithms to find an appropriate price to sell their rooms at under various conditions such as lead time, length of stay, segment, room type etc. But then, of course, there is the emotional component. How does the revenue management function ‘feel’ about the weeks and months ahead. Q1 2024 has been bumpy. Occupancy hasn’t always been easy to forecast and with the head winds of sticky inflation and recessionary pressures growing, pricing hotel rooms hasn’t been easy.

Introduction

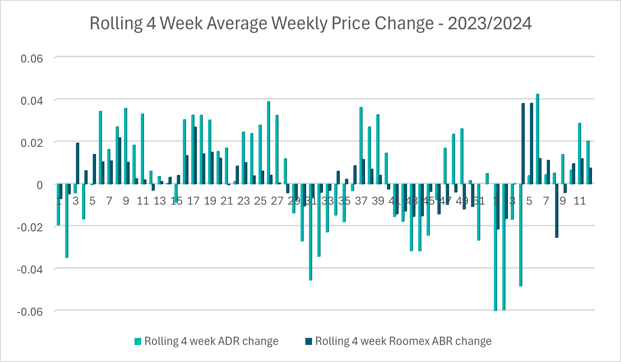

It’s interesting to compare Q1 2024 to Q1 2023. Last year, price increases through the early weeks were strong and sustained. The first 4 weeks were increasingly less negative as the holiday period dropped out of the rolling 4 week average and then, from week 4 to 15, there was a continuous increase. 2024 has been different. The early weeks took time to shed the lows of the end of Dec/early Jan, but this has been followed by very sharp rises followed by a softening. In summary, much more volatility in pricing – interestingly more volatile than is shown in total UK demand.

Report

Outside of school half term week, total UK hotel room demand has been robust and continuously upward during Q1. In the first 10 weeks of the year market data shows 26.8m room nights checked in compared to 24.3m in 2023. So why the volatility in price? Essentially forward visibility seems to have been clouded by bleak economic news. The UK reported falling into recession in H2 2023. Whilst it may turn out to be mild and short, it’s unwelcome news. This, combined with interest rates continuing to bite, has increased the pressure on sectors such as building materials, and construction. In such circumstances, it is business travel costs that are called into question.

The below chart shows the rolling 4 week price movement over the full year 2023 and into 2024:

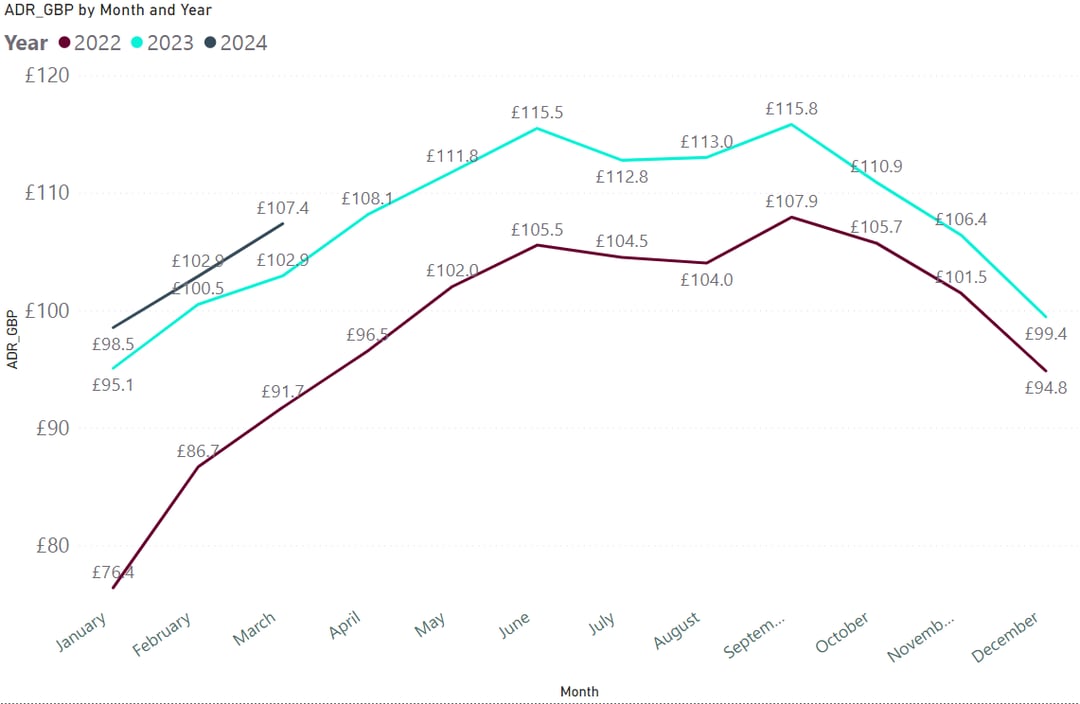

The monthly view in the second graph smooths out these bumps, but the comparison to previous years is telling. ADR saw substantial rises between 2022 and 2023, although a stronger decline in Q4 2023, which ties in with a harsher economic climate. The 2024 price increases are comparatively much lower and as mentioned, less confident.

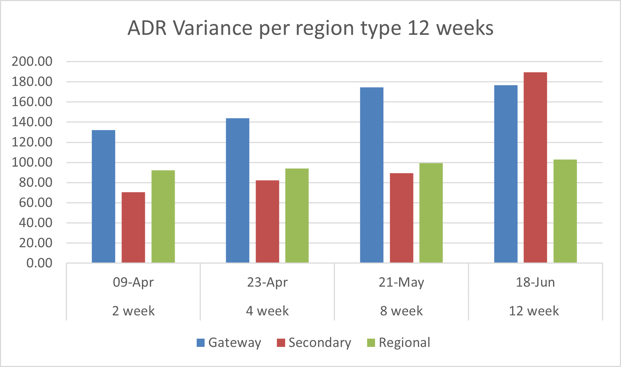

Turning to the forward price data, ADR in the 12 weeks ahead will rise. It also might suggest that some of the nervousness of Q1 eases and hotels apply more confidently apply consistent rises.

The 12 week forward figures as always are a better insight into the minds and sentiment of revenue managers rather than an accurate price forecast. What we see is greater confidence in secondary cities than gateway cities (In this case London and Edinburgh). The largest cities show little change between 8 and 12 weeks. Secondary cities see substantial gains – or put another way – are willing to wait a bit to start taking occupancy.

Taking the UK as a whole the 3 star market is currently suggesting a further 37% price increase between weeks 15 and 25. 15.7% of this is in by 21 and the rest beyond this point making it subject to change.

"...Taking the UK as a whole the 3 star market is currently suggesting a further 37% price increase between weeks 15 and 25..."

Summary

In the Q1 report we commented on strong forward ADR growth. Much of it didn’t materialise despite robust demand. For a range of reasons, hotels started the year strongly but lost confidence. The data is also support anecdotally.

Certain sectors of the business travel market have changed their spend patterns. Building materials companies have reined in costs aggressively at the end of 2023 and are not releasing spend yet.

That said, total market Room Nights checked in the UK has been robust. Having got to grips with changes in the market it’s likely we will see a more consistent upward price movement in the months ahead, perhaps with less froth in large cities.

Roomex offers guidance to all its clients to navigate these trends and ensure their travellers are always comfortable and well rested but at the same time, managing accommodation procurement in the smartest way possible.

About the Data

Sample set of 50,000 price points used from UK and Ireland Hotels. All data is from 3 star hotels only to reflect Workforce travel requirements

Research and Analysis

Sarah Stenson

Alex Watson

To access the PDF version of this report click here.

March 28, 2024