Are you looking for an easy way to calculate and track business mileage allowance in the UK?

With more professionals than ever before working remotely and travelling to meetings and events across the country, it’s important to understand how much your team can claim back in expenses.

While COVID-19 completely disrupted business travel back in 2020, according to the British Interactive Media Association (BIMA), business travel saw an impressive 33% growth by March 2023 compared to the same time in 2019. The chances are, this trend is likely to continue as we head further into 2024.

But with strikes still causing chaos to the travel industry along with rising inflation, getting to grips with mileage allowance relief for UK businesses is one way that organisations can be proactive in their approach to lowering the costs associated with corporate travel.

So, let’s jump into mileage allowance and discover how corporate travel management software like Roomex can help your organisation manage its business travel expenses.

What is mileage allowance?

Let’s start at the beginning and find out what mileage allowance is. Put simply, mileage allowance is a tax-free payment made by businesses to their employees who use their own vehicles for work purposes.

Anyone is entitled to a mileage allowance if they use their own vehicle for work. That includes those who use their vehicle to travel between different locations for work and those who use their vehicle for business purposes only. However, the amount an individual employee receives depends on factors like the distance they’ve covered, the type of vehicle they use, and their salary.

Rates for mileage allowance

The rates for mileage allowance in the UK, set by HMRC, from the tax year 2011-2012 onwards, are as follows:

Cars and vans

- 45p (first 10,000 business miles in the tax year)

- 25p (each business mile over 10,000 in the tax year)

Motorcycles

- 24p (first 10,000 business miles in the tax year)

- 24p (each business mile over 10,000 in the tax year)

Bicycles

- 20p (first 10,000 business miles in the tax year)

- 20p (each business mile over 10,000 in the tax year)

What is mileage allowance relief?

Mileage allowance relief in the UK is a tax deduction for employees who have escrowed business mileage and are not reimbursed by their employer in full.

If employees receive mileage allowance payments from their employer, their ability to claim mileage tax relief in the UK is dependent on their individual circumstances.

When mileage allowance relief can be claimed

Employees can claim if:

- Their employer reimburses them under the approved amount of mileage allowance

- Their employer doesn’t pay any mileage allowance at all

When mileage allowance relief can’t be claimed

Employees can’t claim if:

- Their employee has fully reimbursed their mileage expenses.

- They are paid more than the amount of mileage allowance payments approved by HMRC

- They earn less than the personal tax allowance and, therefore, don’t pay tax

How does mileage allowance impact business expenses?

Businesses in the UK aren’t required to pay their employees mileage allowance. However, many choose to reimburse their employees because anything paid under or at the same level as the mileage rates approved by HMRC doesn’t need to be reported.

A business can choose to pay the exact amount of mileage allowance outlined by HMRC, or they can choose to pay more or less than those rates. Bear in mind, however, that if you pay more per mile than the HMRC rate, the excess sum is deemed a personal benefit that employees have to pay tax on.

HMRC has a wealth of resources on business travel expenses if you’d like to learn more.

Tips for managing your business travel expenses

Managing accommodation costs, business mileage, and other business travel expenses is vital for the smooth running of your business. Here are some ideas for best practice:

Have a clear travel policy

Having a clear and accessible travel policy will ensure you and your employees are singing from the same hymn sheet. A travel policy should explain how employees can spend money while at work business and what they can claim back. Check out this blog if you need advice in creating a best-in-class travel policy.

Reimburse employees quickly

Your employees may not mind travelling for work, but the cost of running a vehicle can quickly add up. Waiting weeks for business travel expenses to be reimbursed can be frustrating and stressful when you’ve got bills to pay, so ensure your process is as slick as possible.

Make it easy for employees to claim

Embracing technology will make it easier for your employees when it comes to submitting their expenses. Being able to submit business travel expenses online through corporate travel management software or mobile app is convenient, easy, and quick.

Use travel booking software

Corporate travel management software like Roomex allows you to manage and view all your business travel expenses in one place. Travel booking software eliminates the need for endless paperwork and reduces the risk of mistakes.

Looking for more advice on how to manage business travel expenses? Check out our complete guide on managing business travel expenses here.

How Roomex Can Help

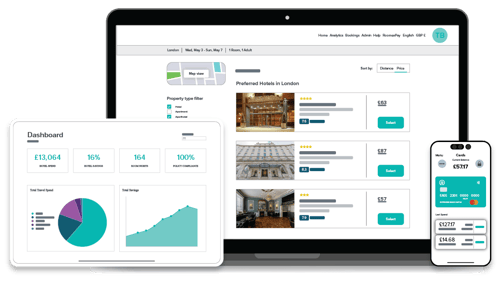

Roomex is travel booking software designed to make the booking and management of business travel expenses effortless. The centralised platform allows you to book, manage and track all corporate travel activities in one place.

The platform is completely customisable, allowing you to set and enforce its own travel policies, ensuring a compliant and streamlined approval process.

Our customers can also benefit from our advanced analytics and reporting functions. These tools help businesses track their travel spend, spot opportunities to make saving, and enhance their travel budget.

Find Out More

If you’re considering introducing corporate travel management software to your organisation, we’re here to help. Roomex offers an integrated solution where you can manage and track all your business travel expenses in one place. Find out more about how we help our corporate clients manage business travel expenses.

January 17, 2024