Expense fraud is something you wish didn’t happen, but turning a blind eye to it could cost your business thousands.

Before moving any further, let’s let the numbers speak for themselves, sourced from the 2020 annual report by the Association of Certified Fraud Examiners (ACFE), and their 2019 Benchmarking Report.

- Theft by employees costs companies around 5% of their annual revenues or $4.5 trillion on a global level.

- There are many ways employees commit fraud against their employers, however, 55% of all crimes cited were of employees creating fraudulent physical documents. This is possible and most common when companies have outdated expense reporting methods.

- A lack of internal controls contributed to nearly ⅓ of all fraud

- 60% of organisations expect to increase their investments in anti-fraud programmes over the next 2 years

Since we’re all on the same page that fraud is real and happens all around us, let’s figure out some reasons how it happens, and how it can be stopped

We’re focusing here on fraud in expense reports, as they are the most common type of fraud related to workforce travel.

- 1. Vague travel and expense policies

You shouldn’t underestimate the importance of creating strong travel and expense policies. Most big companies have strong, detailed travel policies in place but even they forget to add information on alcohol, car washes, GPS, train ticket upgrades, or hotel laundry. The clearer you are in drafting these policies, the more difficult it will be for employees to cheat on their expense reports. Download our Expense policy template to get started. - 2. Employees not feeling valued and ‘pay themselves back’

Lots of employees feel burnt out, unrecognised and unfulfilled. This is due to many things, from poor compensation to micromanagement to constant travelling. Whatever it may be, they pay themselves back with small expense report deceptions. So, value and prioritise your team! - 4. An oppressive travel policy

I know we just mentioned the problem with vague expense policies- however, if you go draconian on your employees it can create an ‘us vs. them’ culture in your company, and will hurt your bottom line when employees cheat on future reports to ‘get back’. Aim for the sweet spot here where the policy is clear, but exceeding policy, especially when it’s necessary, think the cost of travelling to London vs Birmingham, will not garner punishment. - 5. Employees learned from their boss, who learned from their boss...and so on

Just as kids copy the behaviour of their parents, employees will mimic the behaviour of their superiors. If your top execs are splashing out on fancy dinners and drinks, chances are at least a few employees will follow suit. - 6. Human error

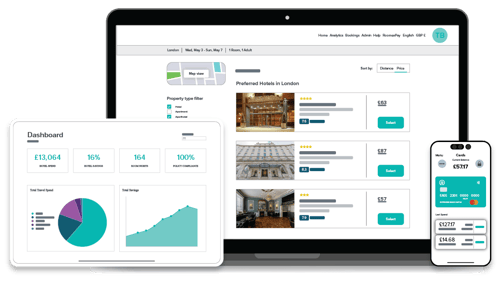

Everyone makes mistakes. Sometimes even the most attention oriented travel managers book a room out of policy, or an employee submits the same receipt twice. These mistakes are tough to spot in a traditional expense management system, but easy in modern ones like RoomexPay. - 7. Managers make mistakes too

Managers are not accountants, and shouldn’t be. Once the employee organises their receipts and records it in the companies excel sheet, they send it on to their boss to approve. The manager typically will approve or misread some sections, maybe skipping over fraudulent claims, because again, they are not an accountant! Take them out of the equation and reduce fraud.

And… there’s likely more. Clearly fraud doesn’t present itself in obvious ways and can be extremely time consuming and difficult for even the sharpest accountants to catch. Between the complications of detecting fraud and the lack of real-time data that traditional expense management practices provide, it’s inevitable that expense report fraud is occurring. But, it can be stopped.

Download our 'Guide to using expense management to unlock company-wide savings' to find out how one small change to your expense management process can work to deter fraudulent behaviors.

Tags:

Finance

December 1, 2020